by Taylor Brown | Aug 22, 2023 | Featured

As of tax year 2023, SECURE Act 2.0 provides generous tax credits to small companies who start qualified retirement plans. Your company may qualify for three multi-year credits for: 1 Employer contributions made on behalf of participants Tax Credit Available: Up to...

by Taylor Brown | Aug 2, 2023 | Learning

Myth 401(k) plans are only for large businesses. Reality Even small businesses can set up and offer 401(k) plans to their employees. In fact, many small business owners find that offering a 401(k) plan can be a powerful tool for attracting and retaining top talent....

by Taylor Brown | Aug 1, 2023 | Learning

With the recent passing of Secure Act 2.0, new tax credits may be available to you, making a 401(k) plan with WELLthBuilder even more affordable. WELLthBuilder is an offering of Strategic Retirement Partners (SRP). Learn more about us at...

by Taylor Brown | Jul 29, 2023 | Learning

Many states have started, or may soon start, programs that require small businesses to automatically enroll employees in a state IRA program if they do not have a 401k or other workplace retirement plan. The intention of the state plans is noble, as encouraging saving...

by Taylor Brown | Jun 29, 2023 | Learning

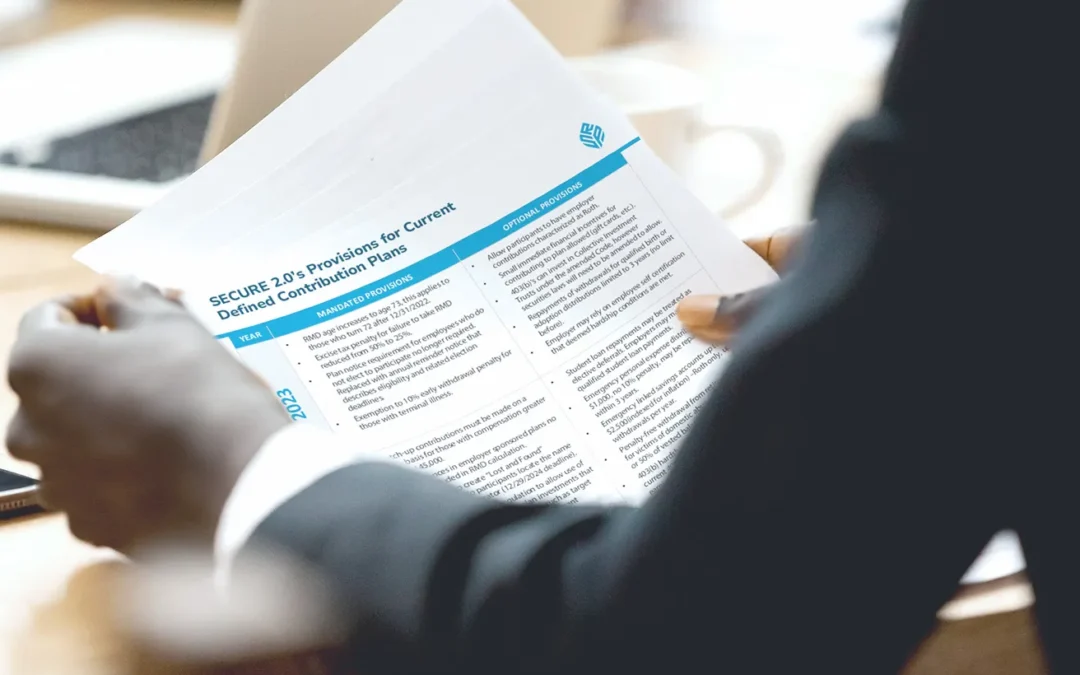

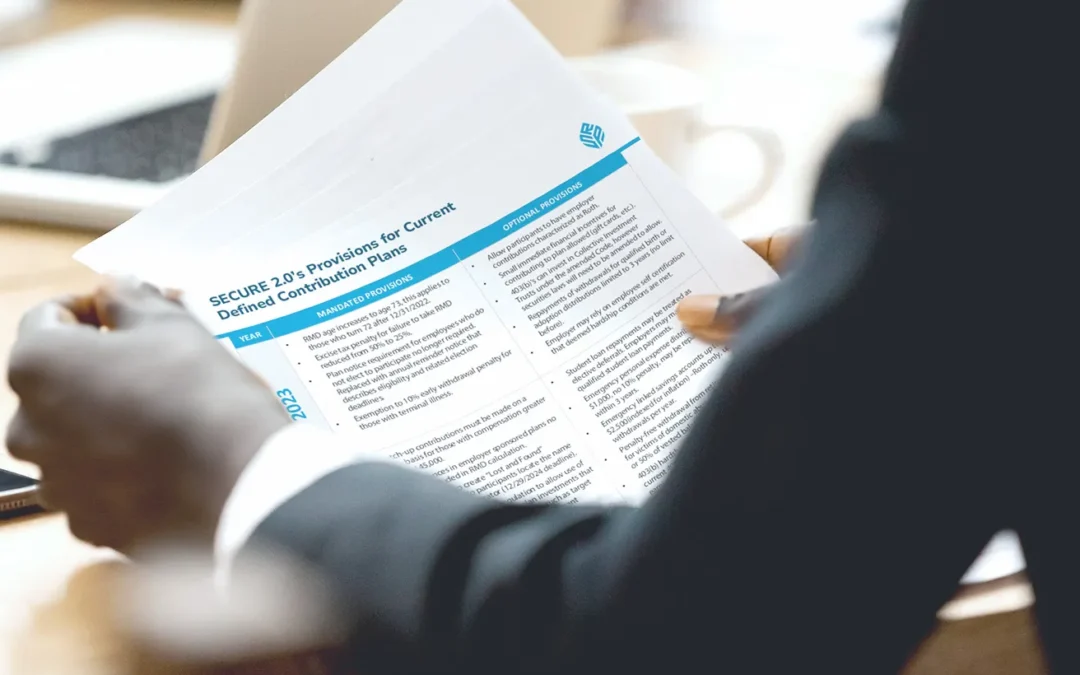

SECURE Act 2.0 introduces important changes to defined contribution plans. Here’s a quick look at some of the highlights. 2023 Mandatory Provisions The age for Required Minimum Distributions (RMDs) has been increased to age 73. This change applies to...