Choose an easy-to-start WELLthBuilder plan.

Create a successful retirement path guided by a professional plan advisor.

Solid Start

$300/mo + $6 per participant/mo

+ 0.50% fee on assets (annualized)

+ $500 one-time startup fee

- Payroll integration with 100+ providers to make plan administration easy (including ADP, Paychex, Paylocity, Paycor)

- Flexible plan design options (traditional and safe harbor) including:

- Vesting schedules

- Flexible profit-sharing formulas

- Compliance testing

- Fiduciary Support to reduce time and risk

- 3(16) plan administration fiduciary

- 3(38) investment management fiduciary

- “Do-it-for-me” managed accounts available to simplify participant investing

- Government filings, including signing Form 5500

- A dedicated onboarding specialist for your plan

HR Edge

$400/mo + $6 per participant/mo

+ 0.50% fee on assets (annualized)

+ $500 one-time startup fee

Everything in Solid Start, plus:

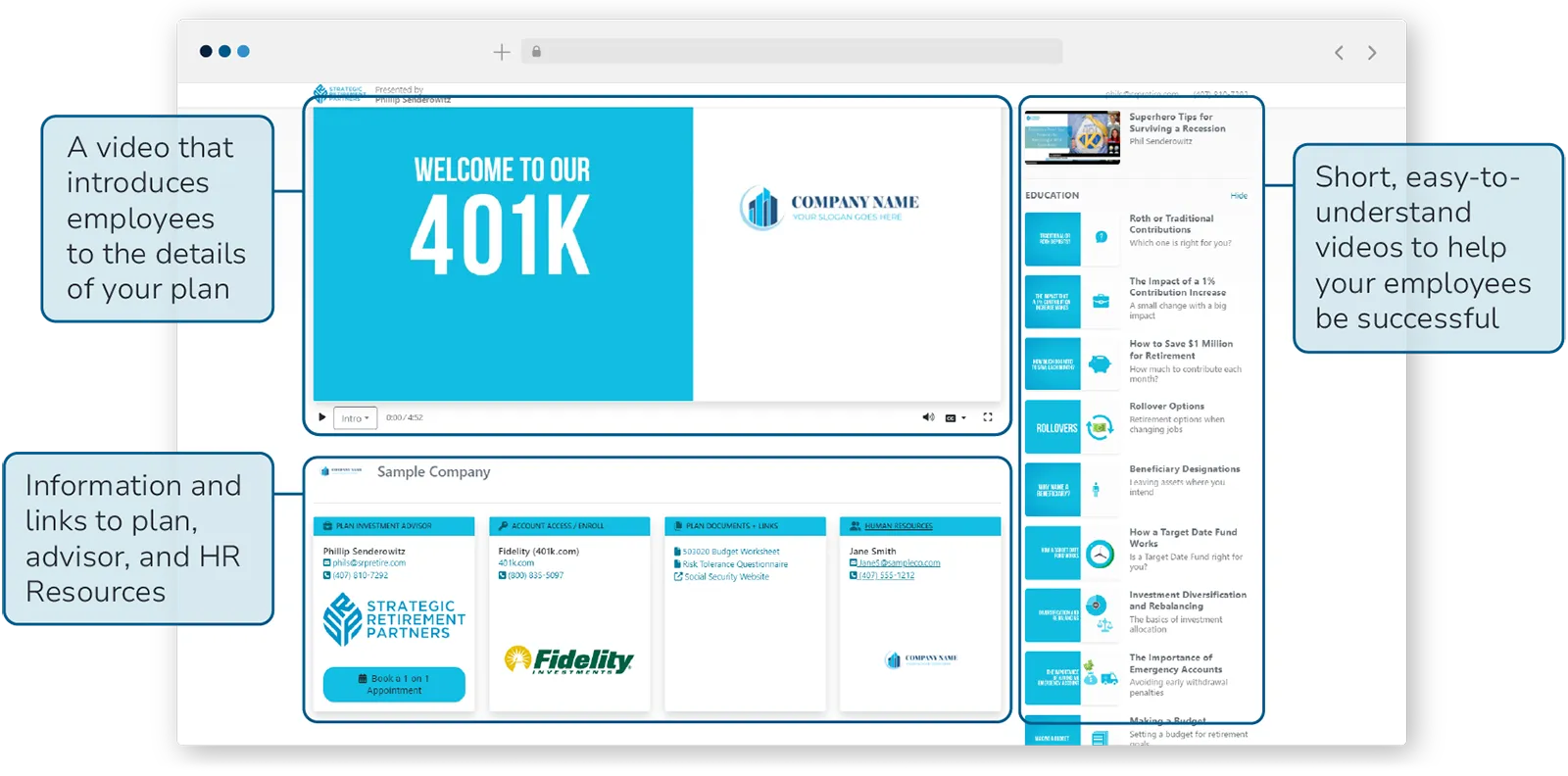

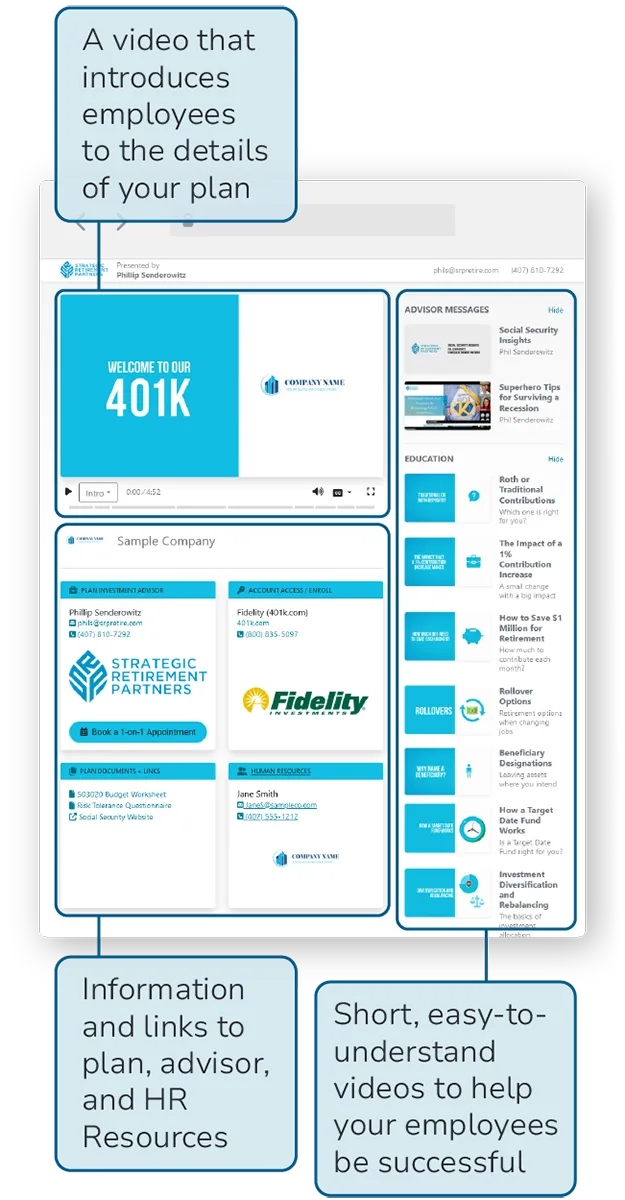

- A custom participant web experience that augments your HR

What’s this? | See a live demo - Quarterly educational webinars for your employees

- A dedicated plan relationship manager

Premier Access

$500/mo + $6 per participant/mo

+ 0.50% fee on assets (annualized)

No startup fee!

Everything in HR Edge, plus:

- Training for plan fiduciaries

- Quarterly employer meetings on request

- Premium 401(k) Superhero participant experience

- Access to 1-on-1 participant advice

Tax Credits

SECURE Act 2.0 provides significant, multi-year tax credits for companies starting new qualified retirement plans. These tax credits could cover some or all of your plan costs for the first three years.

Need help deciding?

Want to chat about a more customized approach? We’re here to help.